Amur Capital Management Corporation - The Facts

Amur Capital Management Corporation - The Facts

Blog Article

Amur Capital Management Corporation Things To Know Before You Get This

Table of ContentsThe Greatest Guide To Amur Capital Management CorporationThe Ultimate Guide To Amur Capital Management CorporationThe Ultimate Guide To Amur Capital Management CorporationThe Best Strategy To Use For Amur Capital Management CorporationGet This Report on Amur Capital Management CorporationExcitement About Amur Capital Management Corporation

The firms we adhere to require a solid record typically at the very least 10 years of operating background. This means that the firm is likely to have encountered a minimum of one financial decline which management has experience with adversity in addition to success. We seek to exclude business that have a credit history quality listed below financial investment grade and weak nancial stamina.A company's capacity to increase rewards consistently can demonstrate protability. Business that have excess cash ow and strong nancial placements commonly select to pay dividends to bring in and compensate their investors.

Amur Capital Management Corporation for Beginners

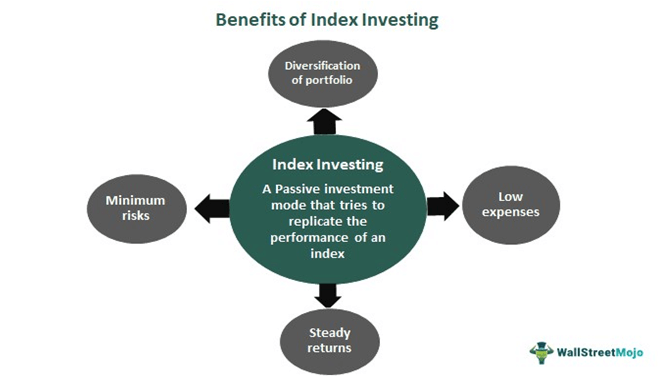

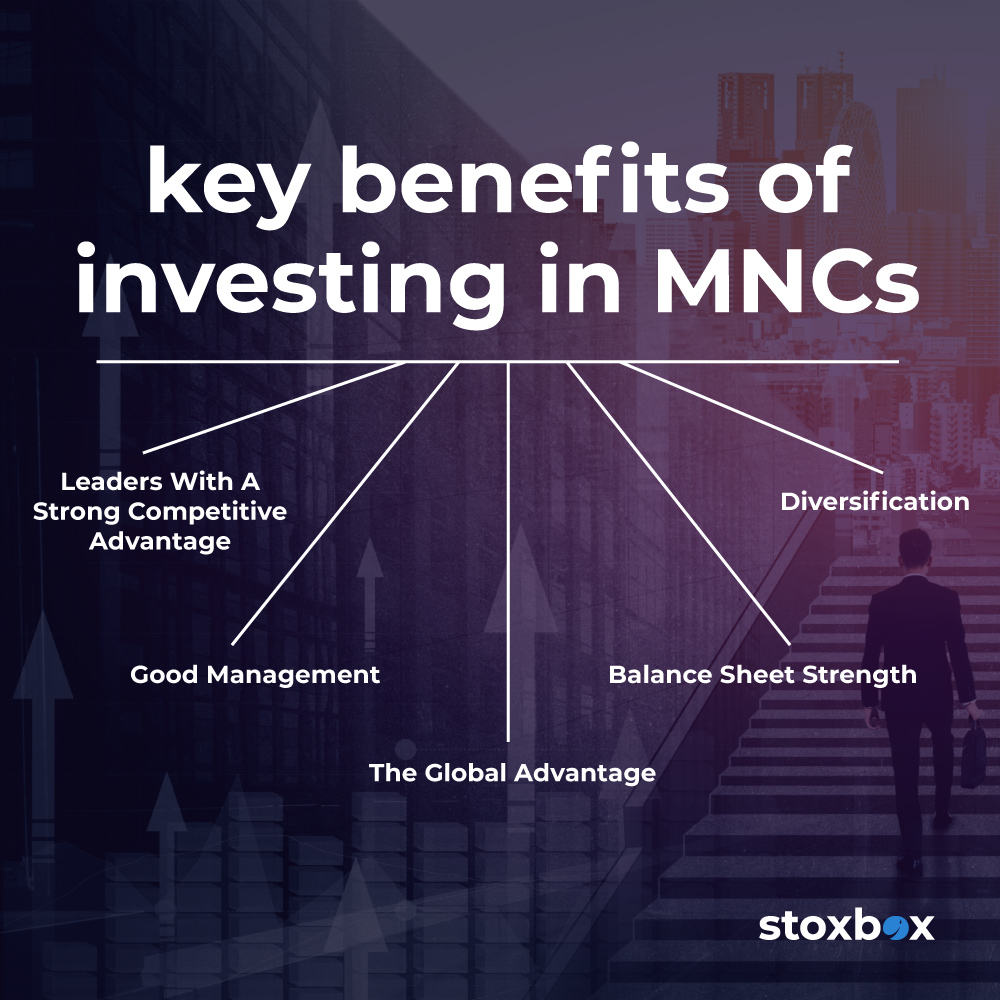

We have actually located these stocks are most in jeopardy of reducing their rewards. Diversifying your financial investment profile can aid protect versus market uctuation. Look at the following variables as you prepare to branch out: Your portfolio's possession course mix is one of the most vital variables in figuring out performance. Look at the dimension of a business (or its market capitalization) and its geographical market united state, developed international or emerging market.

In spite of just how very easy electronic financial investment monitoring systems have made investing, it should not be something you do on a whim. If you choose to enter the investing world, one thing to think about is just how long you actually desire to spend for, and whether you're prepared to be in it for the lengthy haul - https://allmyfaves.com/amurcapitalmc?tab=Amur%20Capital%20Management%20Corporation.

Actually, there's an expression usual related to investing which goes something along the lines of: 'the round might drop, however you'll wish to make certain you're there for the bounce'. Market volatility, when economic markets are fluctuating, is a common phenomenon, and long-term might be something to assist smooth out market bumps.

Amur Capital Management Corporation for Beginners

Keeping that in mind, having a long-term technique might aid you to profit from the marvels of substance returns. Joe spends 10,000 and earns 5% returns on this financial investment. In year one, Joe makes 500, which is repaid into his fund. In year two, Joe makes a return of 525, because not just has he made a return on his first 10,000, but likewise on the 500 invested reward he has made in the previous year.

The Best Guide To Amur Capital Management Corporation

One method you could do this is by securing a Supplies and Shares ISA. With a Stocks and Shares ISA. alternative investment, you can spend as much as 20,000 per year in 2024/25 (though this goes through alter in future years), and you don't pay tax on any kind of returns you make

Obtaining started with an ISA is truly easy. With robo-investing systems, like Wealthify, the effort is done Visit This Link for you and all you require to do is select just how much to spend and select the danger degree that fits you. It might be just one of the few instances in life where a less emotional strategy might be useful, but when it involves your financial resources, you could wish to listen to you head and not your heart.

Remaining focussed on your long-lasting objectives could aid you to prevent irrational decisions based on your emotions at the time of a market dip. The tax treatment depends on your private situations and may be subject to alter in the future.

Some Known Facts About Amur Capital Management Corporation.

Spending goes one step better, assisting you achieve personal goals with 3 considerable benefits. While conserving ways alloting part of today's cash for tomorrow, investing methods putting your money to function to potentially gain a far better return over the longer term - accredited investor. https://www.avitop.com/cs/members/amurcapitalmc.aspx. Different classes of investment possessions money, fixed passion, building and shares normally generate various levels of return (which is loved one to the danger of the investment)

As you can see 'Growth' possessions, such as shares and residential property, have traditionally had the best total returns of all possession courses however have actually also had larger tops and troughs. As a capitalist, there is the potential to gain capital growth over the longer term along with a continuous revenue return (like returns from shares or rent from a home).

Amur Capital Management Corporation Fundamentals Explained

Rising cost of living is the recurring surge in the cost of living over time, and it can affect on our economic wellbeing. One means to help outmatch rising cost of living - and generate positive 'real' returns over the longer term - is by investing in assets that are not just efficient in supplying greater earnings returns yet additionally offer the potential for capital development.

Report this page